James Stone Breaks Down Salmon Season Setting Process

Subscribe to The Fish Sniffer

Stay up to date with the latest fishing reports and expert tips.

Stay up to date with the latest fishing reports and expert tips.

Striped bass in the spring run through Northern California's rivers put on a show that keeps locals coming back year after year. These fish move out of the Delta and up the Sacramento and Feather syst...

Imagine hooking a sturgeon out in the Delta and feeling that first heavy pull that bends your rod clean over. It's the k...

Rainbow trout are the main draw on Folsom Lake right now with spring pushing surface temps to 54 degrees, the reservoir ...

Striped bass in the California Delta are the kind of fish that keep guys coming back year after year. These linesiders m...

Reel Addiction Sportfishing out of San Francisco Bay is doing lots of prep and has exciting things coming up for the upcoming seasons. They run two boats that always come back with huge hauls, fishing...

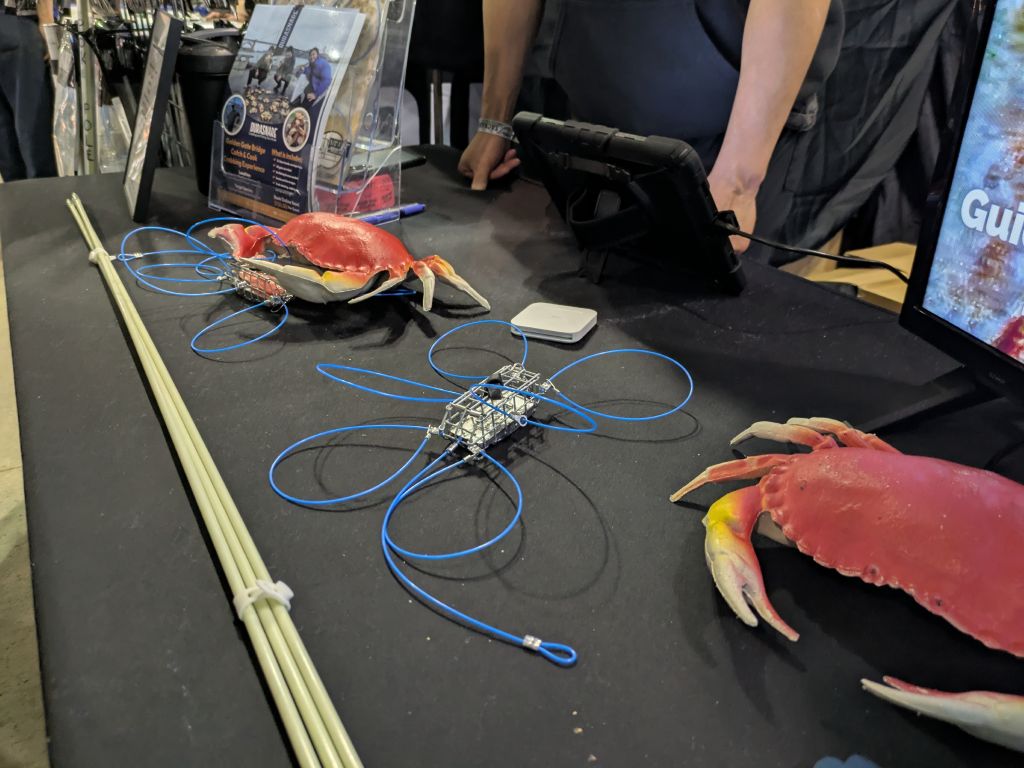

Lawrence Ngai from Durasnare went poke-poling at low tide and brought back a good haul: one greenling, one monkeyface pr...

The Fish Sniffer team had a great time at the International Sportsmen's Expo this weekend. It was awesome to catch up wi...

The Fish Sniffer team had a great time at the International Sportsmen's Expo this weekend. We enjoyed meeting up with ou...

Check out the new Issue of The Fish Sniffer magazine for February 27, 2026. We cover everything from what's happening at Lake Amador, American River, Bullards Bar, Camanche, Eagle Lake, Folsom Lake, Los Vaqueros, New Melones, Pyramid, the Delta, Lake Shasta and more!

We're all getting amped up for salmon season in California, but the rules and regs for 2026 are still in the works. Check out this video where James Stone, president of NorCal Guides & Sportsmen Assoc...

Striped bass in the spring run through Northern California's rivers put on a show that keeps locals coming back year aft...

Imagine hooking a sturgeon out in the Delta and feeling that first heavy pull that bends your rod clean over. It's the k...

Rainbow trout are the main draw on Folsom Lake right now with spring pushing surface temps to 54 degrees, the reservoir ...

Mike Cooper of MADE Baits caught this brown in the Eastern Sierras. He hit the river reservoir edge during the tail end of a fall storm before check in and found a heavy pumpkin colored buck brown. It...

Rio Vista/Delta Get Ready for Spring Striper and Sturgeon Fishing! RIO VISTA - The latest storms, resulting in muddy and...

BURSON – Shore anglers and rental boaters are catching big numbers of black bass, particularly smallmouths, at Pardee La...

ANGELS CAMP – While kokanee salmon fishing has petered out as the fish go upriver to spawn, fishing for rainbow trout is...

Hefty largemouth bass are the reward for anglers using live scopes to locate fish. Use shad pattern swimbaits, jigs and other lures for the best success.

Holdover rainbows, recent planters and king salmon are being caught by experienced anglers. Troll with Trout Trix Worms, Speedy Shiners and other lures from the surface to 25 feet deep.

Sanddabs, along with petrale sole and mackerel, are the reward for anglers venturing out on charter boats out of Santa Cruz and Monterey. Tom’s jigs, tipped with squid strips, are the top lures.

Trollers are catching rainbow trout on spoons and plastic worms behind dodgers. Shore anglers are hooking trout while tossing out PowerBait and nightcrawlers.

The spotted bass action should shift into high gear for anglers using small swimbaits and soft plastics. Expect to catch fish in the 15 to 25 foot range.

Fishing for striped bass is tough on the Delta. However, anglers trolling Dredger lures and spooning in the Port of Sacramento and Deep Water Channel are catching fish averaging 6 pounds.

The stretch of river below Nimbus Fish Hatchery is producing steelhead. Anglers are throwing spoons, drifting nightcrawlers under floats and pulling an array of plugs.

The steelhead season is in full swing. Boaters are hooking bright steelies while pulling plugs, while shore anglers are using fish pills, yarn and salmon roe.

Rainbow and brown trout are hitting flies on the Truckee River. The stonefly hatch is expected to begin in March.

Steelhead fishing has been tough since dam removal. However, one guide reported catching and releasing 6 adult fish while fly fishing on a recent trip.

The lake reopened to fishing on February 6. 4,000 pounds of rainbow trout went into the reservoir before the opener

Catch-and-release sturgeon fishing has been productive. Use ghost shrimp, salmon roe and lamprey eel for the sturgeon.

Rockfish and lingcod season will begin on April 1. Expect to bag limits of colorful rockfish, along with lingcod, while using bars, jigs and shrimp flies.

It won’t be long before the striper run begins in the Sacramento and Feather rivers. The fish typically start moving into the rivers in early March.

Expect the perch fishing to pick up off the Sonoma County Coast in March and April. Toss out pileworms, shrimp and plastic grubs for the best action.

Bay Area party boats will begin trolling anchovies and herring for halibut in March. This should be another great halibut season.

We're all getting amped up for salmon season in California, but the rules and regs for 2026 are still in the works. Check out this video where James Stone, president of NorCal Guides & Sportsmen Assoc...

Nor-Cal Guides and Sportsmen’s Association: The Sportsman’s Voice The Nor-Cal Guides and Sportsmen’s Association (NCGASA...

CDFW to Host Public Meeting on California’s Salmon Fisheries Sacramento - The California Department of Fish and Wildlife...

SACRAMENTO — Opponents of the Delta Tunnel project last month celebrated their successful campaign against Newsom’s trai...

Tom Guzman knows that when Irvine Regional Park drops 800 pounds of fresh trout into the water, you’ve got to show up with a plan. He recently hit the lake and walked away with a beautiful 2.1 pound l...

Dancin Fish Baits has been busy producing spoons, and they're delivering results for Southern California trout anglers t...

Fish Thug Baits has been producing mini jigs that are working well for Southern California trout anglers this season. Wi...

MADE Baits are getting attention everywhere this season. Originally crafted for trout, these baits have proven so effect...